Photo by Shubham Dhage on Unsplash

The world of web3: 2022 recap.

The global adoption increases while the bear run continues.

Table of contents

The world of web3 and cryptocurrencies saw major cataclysmic events in 2022. After the sensational bull run of the crypto industry in 2021, the world of cryptocurrencies saw a significant correction and the beginning of crypto winter last year. The short-term investors in the crypto industry lost a lot of money.

The year 2022 also saw a staggering amount of scams in the crypto industry while the adoption combined with mass awareness gradually increased. Several countries also came up with regulations governing the same.

Major organizations also closed due to the worsening crypto winter and their irresponsible trades in conjunction with hyper-inflated investments in several sinking ships(plunging tokens, scams, and fraudulent organizations).

Even well-established organizations like a16z, and Sequoia Capital, lost a lot a majority of their portfolio further strengthening the theory that the crypto industry has still not reached the mass adoption stage. In the upcoming years, we will see more institutional investors and retail investors adopt a mature strategy and avoid falling into the 'crypto FOMO pit'.

From the mountains of money that Zuck is busy burning while building Meta to the rise of Roblox in the metaverse world, especially with the kids, we will explore the significant events that occurred in the last year. These events didn't only shape the web3 industry in 2022 but shaped the crypto and web3 industry for the upcoming decade and much longer. Look how the web3 industry faired in the year 2022 and how it is preparing for 2023.

-Nike launched a metaverse venture called Swoosh

Popular sports company Nike launched a metaverse venture where customers are entitled to buy and sell virtual products.

Nike has officially revealed the.SWOOSH metaverse platform, is a digital space for athletes, creators, collectors, and consumers to come together.

The platform is powered by Web3 technology and will allow users to co-create virtual products with Nike designers.

It will also enable users to wear their virtual goods in video games and other online environments, such as Roblox. Nike has laid the intellectual property groundwork for its entry into the metaverse through a series of patents.

The company has appointed senior executives to lead a metaverse studio and acquired the company of the virtual goods RTFKT.

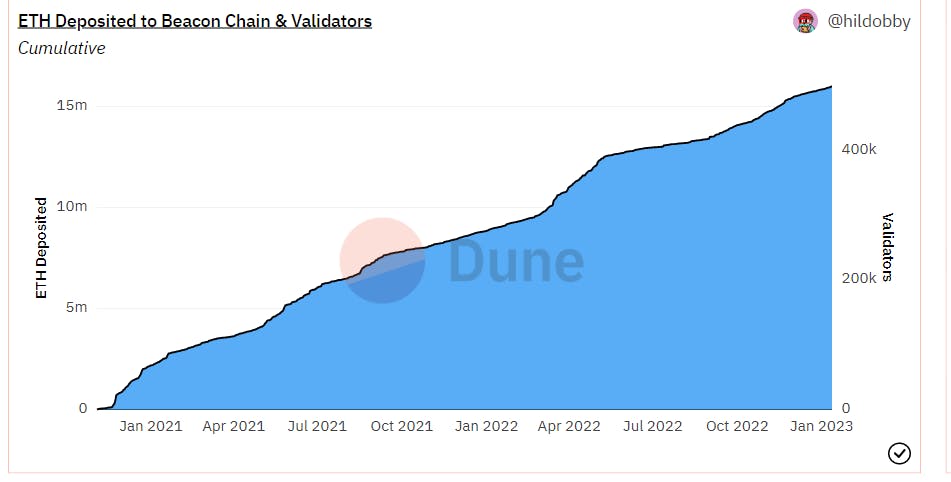

-Growth of staked Ether

The total volume of staked Ether grew in 2022, as more and more users flock to the second-largest cryptocurrency.

According to data from Dune Analytics, more than 16 million Ether, worth over $2 billion, are currently being staked on the Ethereum blockchain.

This is a 20% increase from the end of the second quarter, driven by the Ethereum Merge, which took place in the third quarter.

Ethereum staking is a popular way for crypto traders to capture yield, with the current staking yield hovering around the 4-5% range.

The withdrawal option won’t be available until Ethereum’s next upgrade, “Shanghai”, is expected in 2023.

As more Ether is staked, the yields will continue to decline, making it more difficult to earn rewards.

-February 'Crypto Bowl' 2022

Super Bowl LVI in 2022 was dubbed the “Crypto Bowl” due to the number of crypto advertisers vying for viewers' attention and trust.

Crypto exchange platforms Crypto.com and FTX were two of the major players, running advertising commercials during the event on Feb. 13.

Crypto.com had previously secured naming rights for the Staples Center in Los Angeles and purchased a $700 million 20-year contract.

FTX also scored an ad spot, with a trailer starring Tom Brady and Gisele Bündchen in a $20-million campaign.

The Crypto Bowl was a major win for crypto companies, as the increased exposure from a global event like the Super Bowl meant more public awareness of the burgeoning technology.

SensorTower data showed a major spike in crypto ad spending on digital media around October and November of last year, as prices were peaking.

This was also supported by the U.S. Executive Order, issued in March 2022, which emphasized the importance of crypto regulation.

The Merge, or the merger of two blockchain systems, the current Ethereum Mainnet and the Beacon Chain proof-of-stake system, was also a major topic at the Crypto Bowl.

The merge event of the Ethereum blockchain has caused a higher upwards trajectory than Bitcoin and it is believed to have increased support and belief in the industry.

-BAYC Otherside Deed

In march 2022, the bored ape yacht club (BAYC) announced the launch of its Otherside digital land sale.

Yuga labs, the creators of the BAYC NFT project, would open its doors to eager investors on April 30.

The Otherdeed nfts were a unique collection of digital land parcels built atop the Ethereum blockchain.

The Otherside project was a massive metaverse endeavor and would feature an open-world game where collectors could own land and interact with different ecosystems and the unique beings that inhabit them.

The land parcels had been powered by the ApeCoin ecosystem and the only way to participate in the Otherside dropped was to purchase an NFT using $ape tokens.

The Otherside project has been the largest expansion of the bored ape NFT universe yet.

The project promises to blend mechanics from MMORPGs and web3-enabled virtual worlds.

Players had been able to harvest resources and used them in the game, including anima (for research), ore (metal), shards (stone), and root (wood).

The key to the game had been embedded within the unique ecosystem and the enigmatic Kodas that lived within it.

-Yuga Labs acquiring Meebits and CryptoPunks in 2022

In 2022, Yuga Labs, the creators of the Bored Ape Yacht Club (BAYC) NFT project, acquired both Cryptopunks and Meetbits.

This move marked a major shift in the NFT landscape, as it marked the first time that two prominent projects had been acquired by the same entity. Cryptopunks is an Ethereum-based project that was founded in 2017 and is one of the oldest NFT projects in existence.

The project consists of 10,000 unique digital characters that users can collect, trade, and use in-game.

The acquisition of Cryptopunks was seen as a major coup for Yuga Labs, as it further cemented their dominance in space.

Meetbits is an Ethereum-based project that was founded in 2019 and is an NFT-based platform for creating and trading digital art.

The acquisition of Meetbits was seen as a major boon for Yuga Labs, as it allowed them to expand their NFT offerings and reach an even larger audience.

The acquisitions of Cryptopunks and Meetbits solidified Yuga Labs’ position as one of the top players in the NFT space.

The acquisitions also demonstrated their willingness to invest in the NFT ecosystem, which is a major factor in the continued growth of the space.

-Sanctions on Tornado Cash

Article on the Sanction of Tornado Cash by the U.S. Department: In August 2022, the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash for its role in laundering $7 billion, or 300,160 ETH, in digital assets since its 2019 inception.

The sanctions barred all stateside individuals and entities from using the decentralized privacy tool, which “failed to impose effective controls designed to stop it from laundering funds”, according to a Treasury press release.

Tornado Cash is a virtual currency mixer that facilitates private, anonymous transactions in an otherwise fully transparent, public-facing interface.

Swirling together clusters of pending trades, the decentralized privacy tool’s unique service creates flurries of transactions — cash tornados if you will — obstructing on-chain addresses to ensure maximum security.

The protocol accepts token deposits from one address while permitting withdrawals from another.

This allows the ledger to still log a user’s activity without trailing back to their entire financial history.

Before the sanctions were announced, the federal agency had never listed an open-source, software protocol on its Specially Designated Nationals and Blocked Person List.

Customarily, the OFAC targets a person or entity (like narcotics traffickers or terrorists) — not code.

The U.S. Treasury Department accused Tornado Cash of allowing users to launder billions of dollars in virtual currency, including $455 million allegedly stolen by North Korean hackers in May.

OFAC’s designation prohibits transactions to or from Tornado Cash and freezes all assets sitting within its wallets.

The sanctions have left the crypto community wondering what’s next, as the protocol is built on the Ethereum network and can be accessed by any dApp.

Penalties include monetary fines ranging from thousands of dollars to several million and up to 30 years of imprisonment.

-Collapse of Terra Luna

In 2022, the cryptocurrency exchange Terra Luna collapsed, resulting in the loss of over $1 billion in digital assets.

The exchange had been steadily growing since its launch in 2019 and had become one of the largest crypto exchanges in the world.

The collapse was the result of a series of bad decisions, including the acquisition of a rival exchange and a lack of proper oversight.

The exchange was also accused of insider trading and other fraudulent activities.

Additionally, the exchange had been accused of improperly handling customer funds, leading to a collapse in confidence in the platform.

The collapse of Terra Luna left many investors out of pocket and shook confidence in the crypto industry.

The fallout from the incident led to regulatory scrutiny of the crypto sector, as well as new measures to protect investors from similar events in the future.

-Collapse of FTX

In 2022, the cryptocurrency exchange FTX fell victim to a series of security breaches, resulting in the loss of over $1 billion in digital assets.

The exchange had been steadily growing since its launch in 2019 and had become one of the largest crypto exchanges in the world.

The security breaches were the result of a series of bad decisions, including weak security protocols and a lack of proper oversight.

The exchange was also accused of ignoring red flags that indicated potential fraud, leading to a collapse in confidence in the platform.

The fall of FTX left many investors out of pocket and shook confidence in the crypto industry.

The fallout from the incident led to regulatory scrutiny of the crypto sector, as well as new measures to protect investors from similar events in the future.

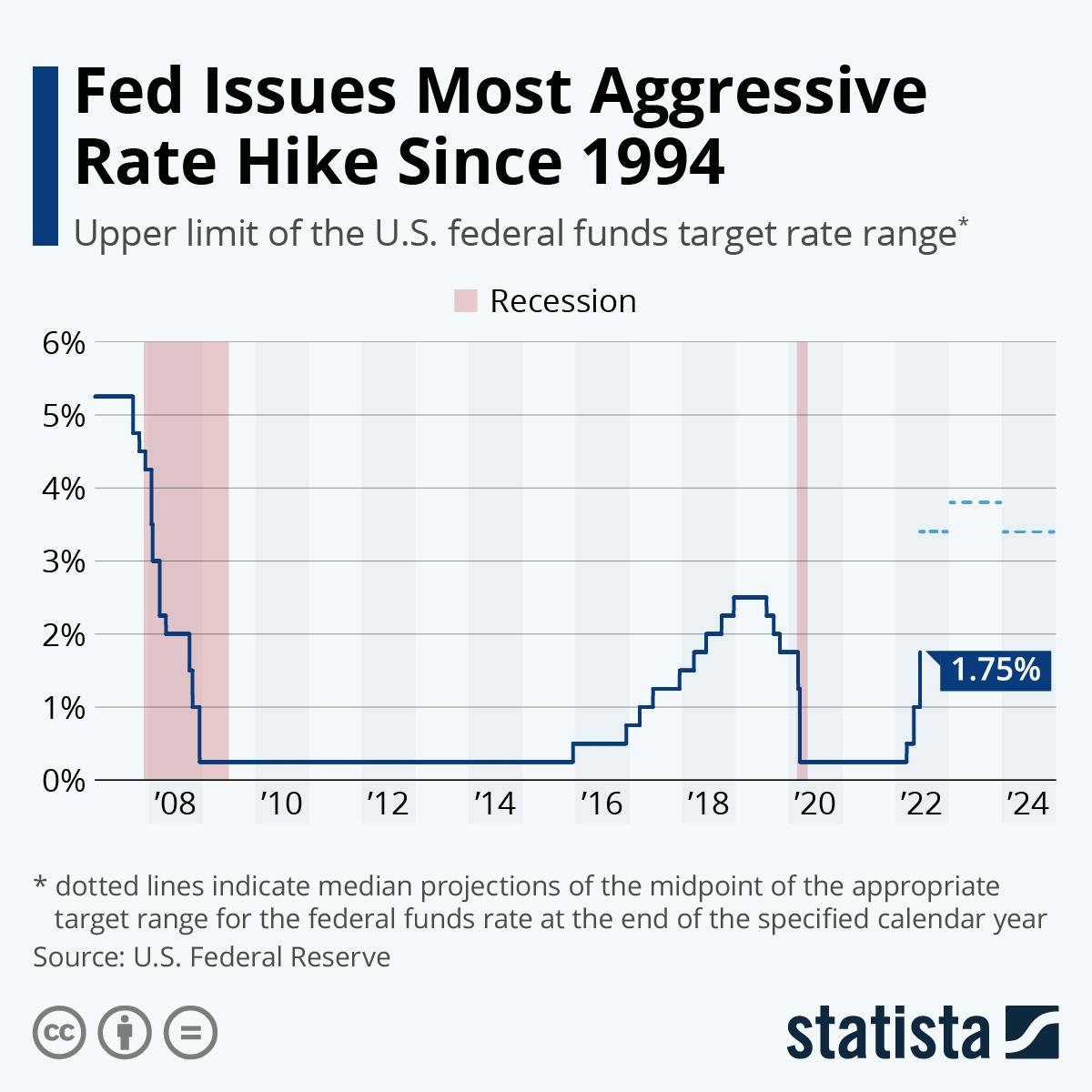

-FED raises Inflation rates in 2022

In 2022, the Federal Reserve increased its key interest rate seven times in an effort to curb inflation, which had been steadily climbing since the start of the pandemic.

The rate hikes represented the largest increase in inflation in decades, and have had a major impact on the US economy and American consumers.

The Fed raised its benchmark rate from 0.25% to 3.75%-4% in response to rising inflation, which had climbed to 8.2% in September of 2022.

The move was seen as a necessary step to cool the economy, as inflation had been steadily rising over the past year despite the Fed’s efforts to keep it at the preferred rate of 2%.

The rate hikes have had a major effect on the US economy, as they have made it more expensive to borrow money.

This includes mortgages, credit cards, car loans, and other forms of borrowing.

The increase in borrowing costs has had a major impact on consumers, as they have had to pay higher interest rates on their loans and credit cards.

The rate hikes have also had an effect on the stock market, as stock prices have dropped in response to the higher costs of borrowing.

The S&P 500 fell 0.5% after the Fed’s announcement on Wednesday. Additionally, the strength of the US dollar has increased due to the higher interest rates, which has had a negative effect on the economies of other countries, as their currencies have become weaker in comparison.

The Fed’s rate hikes are meant to cool the economy and bring inflation back down to its preferred level of 2%, but it remains to be seen if this will be successful.

The Consumer Price Index, which tracks inflation, will be released next Thursday and will give economists a better idea of whether the Fed’s rate hikes have been working.

In the meantime, consumers and businesses will have to deal with the increased costs of borrowing.

-Major Crypto Hacks in 2022

2022 was a year of reckoning for the crypto industry. While the industry was able to make some major strides in terms of adoption and innovation, it was also marred by a series of high-profile hacks.

From a $620 million heist at the Ronin Network to a $325 million theft at Wormhole, hackers managed to steal over $3 billion in crypto from investors in 2022.

One of the biggest hacks of the year was the Ronin Network exploit, which saw hackers steal 173,600 Ether (ETH) from the Ethereum-based sidechain.

The attack was made possible by a bug in the bridge between Ronin and Ethereum, which allowed the hackers to siphon off the funds without being detected. Another major hack occurred in January when the Qubit Finance bridge was exploited for $80 million.

In this attack, hackers were able to take advantage of a vulnerability in the bridge, which allowed them to withdraw more funds than they had deposited. Harmony Bridge also fell victim to a hack in May, with hackers managing to steal $100 million in crypto.

This attack was made possible by a flaw in the bridge’s code, which allowed hackers to withdraw more funds than they had deposited. In August, hackers managed to exploit the Nomad Bridge for $190 million.

This attack was made possible by a software bug that allowed people to withdraw more funds than they had deposited, resulting in a massive loss for the project. The Mango Markets hack in December was also noteworthy due to its brazenness.

A developer named Avraham Eisenberg revealed himself as the hacker on Twitter and ended up returning much of the stolen funds, although kept a handsome windfall of $47 million.

The action set off a debate in crypto, with many arguing that his exploits were legitimate on the Defi principle that “code is law.”

Overall, 2022 was a year of reckoning for the crypto industry, with cybercriminals stealing over $3 billion in crypto from investors.

While some of the hacks were made possible by flaws in the code, others were the result of malicious actors taking advantage of vulnerabilities in the system.

As the industry continues to grow, it is important to remain vigilant and take the necessary steps to protect user funds.